When we study pro wrestling business and try to assess how healthy a company is, we need to recognize the "maturity" of the metrics being considered. As the media landscape evolves, some metrics are still in their childhood, some are adult and some are aging.

To name a few: WWE Network subscribers are immature; attendance is in adulthood; and TV ratings are aging -- and they should be assessed according.

Immature metrics, or metrics still in their "childhood", are ones we can expect to increase indefinitely, even as popularity stays the same or decreases. Metrics in their adulthood are those that generally actually reflect popularity. Aging metrics are those we can expect to decline indefinitely, even as popularity stays the same or increases.

Child Metrics

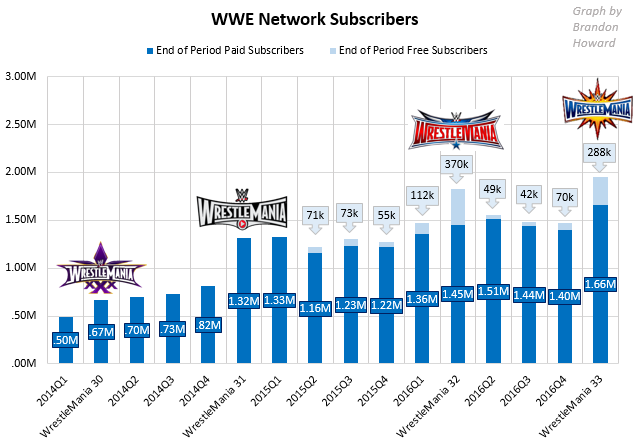

WWE Network subscribers are still in their childhood. Perhaps now they're in their teenage years, with adulthood in sight, a few years away. We're not at the point yet where Network subs tell us much about WWE's popularity over time. We're still at the point where the WWE Network and the technology associated with it is becoming more commonplace in people's lives.

Eventually, I'd say by 2019 or 2020, nearly everyone who's going to accept OTT technology will have accepted it; Network subs will achieve adulthood, and this metric will begin to be a good measure of genuine changes in WWE popularity. WrestleMania, continuing to be the spectacle it is, will still be the annual peak for subscribers, but measurements in other quarters and average sub counts year-over-year will be a useful barometer for understanding interest in WWE.

Adult Metrics

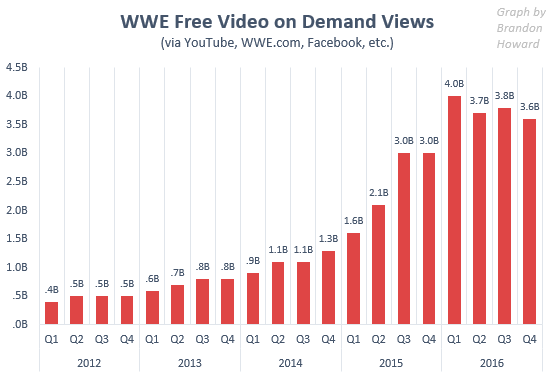

Free video views, including YouTube views, appear to have reached adulthood last year. For several years WWE saw explosive growth in this area, which seems to have leveled off in 2016 at a baseline of 3 to 4 billion video views per quarter. To put that in perspective that's about 40 million views per day, worldwide.

Going forward this metric may be a useful barometer to gauge WWE's worldwide popularity.

Google interest is a useful adult metric also. It measures queries on the internet's most popular search engine for, in this case WWE (and related subjects), divided by all searches on Google. This data is made public using a relative value on Google Trends.

(Click here if this graph isn't loading right.)

This tells us WWE popularity has been pretty stable as well, peaking each year near the time of WrestleMania. (I set this chart to start at 2008 because the data is somewhat skewed by the deaths of the Benoit family in 2007.)

Wikipedia has begun providing similar data, based on pageviews on its site, however the data only goes back to July 2015. This data may become more useful as times goes on.

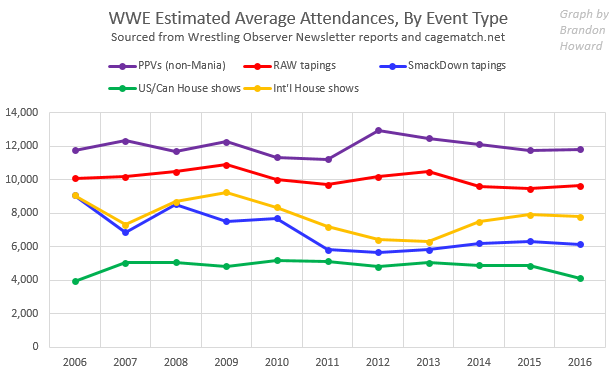

The most traditional business metric in all of wrestling history, attendance, is still in adulthood.

Over the last eleven years, attendance hasn't changed much. SmackDown TV attendance sustained a decline starting in 2011, coinciding with the end of the original brand split. International house show attendance is expectedly volatile due to the variety of markets WWE infrequently tours overseas. Meanwhile PPV, RAW and U.S./Canadian house show attendances have been relatively stable. During this time live attendance revenues and profits have consistently grown, well over the rate of inflation.

Aging Metrics

The most frequent error I see among commentators and fans is looking to television ratings with the expectation that they will be a reflection of the promotion's popularity. While ratings and viewership may or may not be an important determining factor in future contracts for TV rights (WWE's largest single source of revenue), ratings and viewership fluctuations over time are a bad reflection of fluctuations in a wrestling promotion's popularity. Ratings and viewership (which are similar but actually two different metrics) are aging metrics.

Many of us grew up during the historic RAW vs. Nitro ratings war of the late 1990s, when ratings were the unit on the proverbial scoreboard for the WWF vs. WCW competition. Or if you weren't around during that time, you've certainly heard about it. This history unduly colors how we read ratings today.

Comparing ratings of one promotion against itself over time, especially in the current media environment, is complicated. For reasons we need not get into here, ratings for most programming across TV is down, especially scripted programming. Ratings for live sports are more stable, though perhaps those are weakening as well. Pro wrestling TV is a hybrid of both, so we should expect its ratings to suffer less than scripted programming but more than live sports.

The landscape of traditional TV is built into a decline. We should expect WWE's ratings to decline indefinitely -- notwithstanding bandaids like the RAW/SmackDown brand split, which gave SmackDown its own exclusive roster and moved it to Tuesday as a live show, which succeeded in giving that program a temporary boost.

SmackDown's ratings improved thanks to the brand split, but over the course of time we will likely continue to see those ratings decline from that improved position. That decline will probably not indicate a genuine decline in product popularity, as it has not over the course of at least the last ten years.

So what are TV metrics still useful for?

Within a window of a few weeks or a few months, TV viewership (number of people watching) and ratings (percentage of households watching who have access) are meaningful for noticing when something "popped a rating". For example, we know that the WWE audience was genuinely more interested in RAW on the days after WrestleMania and Royal Rumble this year as those episodes were the two biggest ratings of the year, and nothing else this year will likely top those two. But if we compared those ratings (post-Mania: 2.62; post-Rumble: 2.00) to the ratings for even the most recently-passed years, those episodes' ratings look below average.

Furthermore TV metrics can identify changes in demographics. Demographic data is currently published the day after a given airing, on Showbuzzdaily.com. However we need to keep two important points in mind when we look at changes in demographic data over time: 1) Demographic data needs to be looked at against overall viewership, which should be looked at as a baseline, and 2) we need to consider wider viewership trends among demographic groups over the time we are comparing.

What do I mean by that? The two particular phenomena this subtlety currently applies to for WWE viewership is the (genuine) increase in the female audience and the supposed decline in WWE's younger audience.

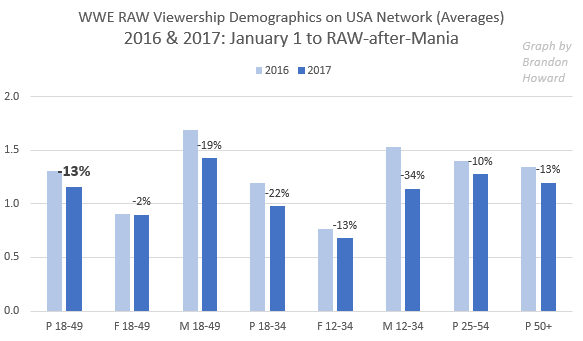

For this year and last year, let's look at RAW viewership from January 1 to the RAW after WrestleMania. We can see that the male audience is deteriorating faster than the female audience.

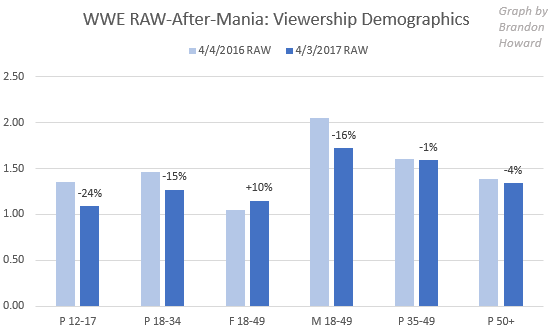

("P" on the bottom axis indicates the entire population, regardless of gender; "F" indicates female audience; "M" indicates male audience; the numbers indicate age range.)

P 18-49 moved -13%. Not pictured in the graph, the overall viewership moved a similar -12%. So all things equal we might expect each group to decline at a similar rate, and any deviations within demographics above or below -12% to indicate a genuine shift in viewership among the given demographic.

The April 10 edition of the Wrestling Observer Newsletter reviewed demographic information for viewership for this year's RAW-After-Mania episode compared to last year's RAW-After-Mania episode. The data the Observer reported is visualized here:

The Observer then concluded the following:

So there has been a very significant trend over the past year and when you only look at the ratings themselves, it hides it. Men are way down and women are up a fairly significant percentage... It’s part of a consistent pattern over the past year in WWE ratings where men have declined greatly over the year while women have stayed the same or even gained.

The decline in men is far more than the rise in women. The current product mix on television is connecting with women in a positive way, but guys are leaving at a percentage that is pretty alarming, particularly the teenage boys are relating far less to the product than one year ago. This is the secret we’ve mentioned a few times that the rise of women has hidden and is the key message of the current ratings. Quite frankly, some of that may be based on the choices by the company on who is on top, or just aspects of what the product is.

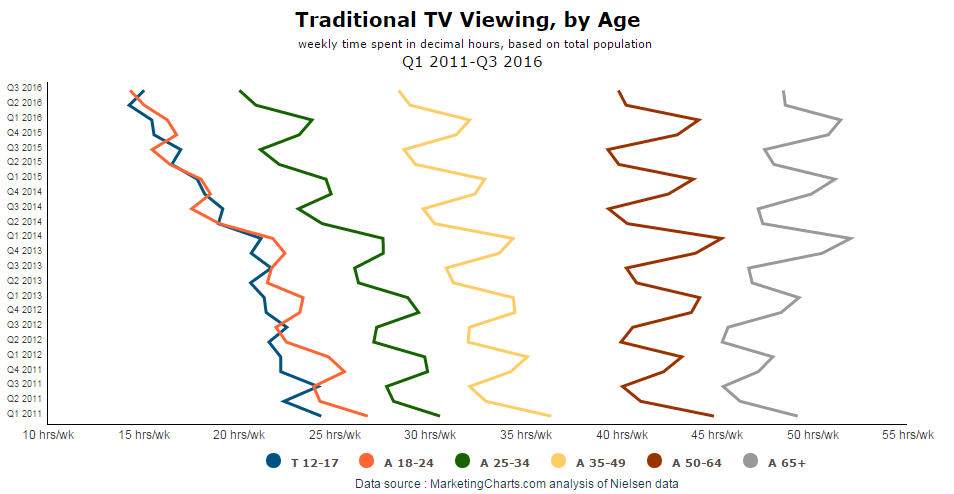

This analysis doesn't mention how the younger television audience in general has changed in recent years. Younger viewers in general are spending less and less time watching traditional TV and more and more time using streaming TV services -- services by the way where WWE content can be consumed (Hulu, YouTube, pirate sites, etc.) without their viewership being counted by Nielsen. This should be considered and accounted for before concluding WWE is losing its younger audience based on traditional TV viewership alone.

(Source: MarketingCharts.com)

While the above study doesn't reveal rates of decline for the younger audience between 2016 and 2017, the rates that RAW's 12-17 (-24%) and 18-34 (-15%) audiences have declined between 2016 and 2017 for RAW-after-Mania probably do still exceed overall viewing habits, yet making appropriate adjustments probably brings the genuine rates of decline down to the single digits.

So I'd conclude: 1) lacking evidence that the male audience is especially more likely than the general audience to use non-traditional means to consume TV and/or WWE, RAW's traditional TV female audience has genuinely increased, and 2) there may be a genuine decline among WWE's younger audience, but a less alarming one, and it's likely WWE's younger audience is increasingly following programming via outlets like Hulu, YouTube and pirate sites.

Again, we should not gloss over the notion that TV rights fees are WWE's largest source of revenue, and declining ratings may or may not harm WWE's ability to get a similarly lucrative deal when major contracts are up in 2019. The company is clearly dealing with an evolving media environment where it needs to figure out how to monetize viewership on new forms of media as well as it monetized viewership on traditional forms of media.

WWE CFO George Barrios, in public talks, has consistently emphasized a "it's too early to tell" disposition regarding future TV contracts, but has also presented the possibility that live programming such as RAW and SmackDown will be even more valuable going forward, regardless of viewership declines, because live programming is the kind that's best weathering the wider decline.

Immortal Metrics

The immortal metric is money: revenue and profit. WWE is a healthy business. It made $80 million in OIBDA last year and projects to make $100 million this year.

Even if we disregard guaranteed, escalating TV revenue from networks, the company's live event and merchandise businesses consistently improve year-over-year. The WWE Network may not be as profitable as pay-per-view, and it's unlikely the opportunity cost has been recouped yet, but it's at least nearly as profitable.

However revenue and profit don't necessarily indicate popularity, if by "popularity" we mean the number of individuals who are interested in the product. It's probably the case that WWE is becoming a more efficient business, marketing itself better and better to its customer base, and getting more dollars out of each person.

Follow Brandon on Twitter at @BrandonThurston. You can reach him by email at [email protected].