Pro Wrestling Company Familiarity and Favorability Study: Survey results on 58 companies including WWE, NJPW, ROH, TNA, Lucha Underground and indies

The entire spreadsheet for this study can be viewed here.

There are many new and interesting metrics to look at when it comes to pro wrestling companies in 2017: Google trends, Wikipedia page views, social media follower counts. It's tempting to look at one set of data and make a conclusion and believe that we know who stands above who in the hierarchy of promotions. Some of the data can be complicated by ambiguities or manipulations. This new information can be insightful if we cross-reference them with other metrics to see if they corroborate the conclusions we suspect; they should be viewed as puzzle pieces that each tell a part of the story. Even then, what most of the new metrics measure is familiarity. They don't necessarily measure market demand or favorability: whether there's an audience out there willing to buy a company's products. This study works to discern that important subtlety.

The results of the survey discussed here tested familiarity and favorability regarding pro wrestling companies. The survey was discovered via platforms like Twitter, Reddit and the Wrestling Observer website. Responses were received in December 2016. Respondents were asked about 58 different pro wrestling promotions. Most every promotion of significant profile was included.

This survey does not give an impression of wrestling fans’ inclinations at-large, but does provide insights on the inclinations of ardent and perhaps influential fans who follow pro wrestling closely online.

It’s my opinion the results of this survey strongly and credibly suggest answers to several questions which were before only the subjects of (at best) popular intuition or (at worst) contested debate.

Who took the survey?

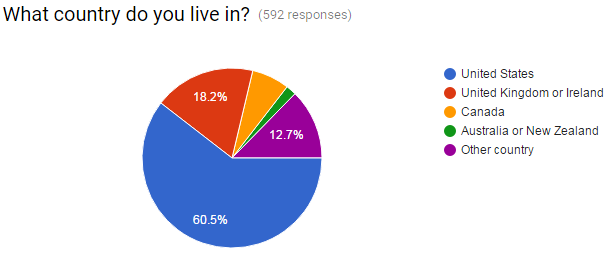

591 responses were received from December 2 to December 7, 2016.

The survey was administered via a Google Form which automatically entered the data into a spreadsheet.

Again, the survey was not intended to and does not give an impression of the familiarities and favorabilities of all wrestling fans, in general. Instead it gives an impression of those sentiments among a subset of wrestling fans of the kind exposed to the platforms the survey was distributed on.

Pro wrestling is a medium with worldwide appeal, so we should also note this survey was distributed in English only. This is especially important when we consider the results for the companies based in Japan and Mexico. This study should be understood as a test of niche, English-speaking wrestling fans. The results here for Japanese and Mexican companies do not necessarily correlate to the sentiments of fans in their home countries, but nonetheless do give an impression of the market demand for those products among English-speaking fans.

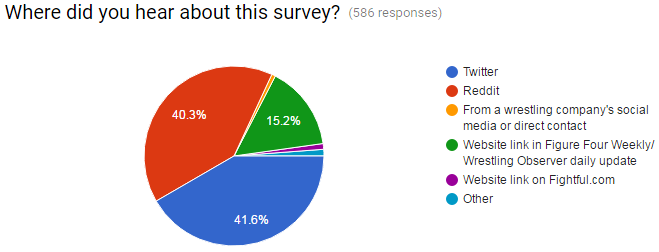

The main platforms the survey was distributed on were Twitter, Reddit and f4wonline.com. The neighborhoods of Twitter and Reddit where this was distributed, as well as the f4wonline.com website itself, are places frequented by wrestling fans with an especially wide-range of tastes.

Most if not all the Twitter responses (42% of all responses) were discovered via my Twitter account or via those who retweeted my tweets asking for responses.

The Reddit responses (40%) were likely all discovered via a post I made in /r/SquaredCircle asking for responses.

A link to the survey was also posted in the daily update for December 5 on f4wonline.com, which accounted for 15% of responses.

The remaining 3% of responses came from a link on Fightful.com or other sources like WhatsApp.

What did the survey ask?

The survey first collected demographic information on home country, age group, gender and where the survey was discovered.

Familiarity ratings for each company on a 0-4 scale were then collected. A response was required for all 58 companies which were sorted at random. The question read:

On a scale of 0 to 4, how FAMILIAR are you with these pro wrestling companies? This is not asking how high your opinion is of the company; that will be asked later. (0 = you've never heard of it; 4 = you're very familiar)

Favorability ratings on a 0-4 scale were collected for the same 58 companies. The companies were sorted the same way for all responses, roughly sorted by region and then by total social media followers. The question read:

Of the companies you have at least some familiarity with, how FAVORABLY do you view these pro wrestling companies? For example, how far out of your way would you go to watch these promotions? How much respect do you have for their products? Etc. (0 = completely unfavorable; 4 = very favorable) You may omit answers for any promotions you're not familiar with.

Despite the wording of the question, many respondents provided favorability responses for companies they rated a 0 on for familiarity. The familiarity question defined a 0 familiarity rating as “you’ve never heard of it”. A favorability opinion on a subject with which one admits having no familiarity on doesn’t seem valuable, so I decided to discard any favorability responses for a given company that a given respondent rated a 0 on for familiarity, as their opinion is apparently completely uninformed based on their own response. I would have liked to automatically eliminate from the favorability question any companies the respondent rated a 0 on for familiarity but Google Forms is not yet versatile enough for that.

Why were these 58 companies selected to be included and not others?

The 58 companies respondents were asked about were included because those were the promotions I found in previous studies of social media to have a high number of followers and/or YouTube views per day. No, social media follower counts do not provide a reliable ranking of which promotions have the most market demand. However follower counts are an all-encompassing metric that can be publicly found for nearly every wrestling company of every size in the world, so it is a useful guide for suggesting which companies to included in a study like this.

The 58 selected are by no means the all-inclusive top 58 companies in the world with the most market demand, although I believe all of the top 30 or so in the world have been included. There are no doubt wrestling companies that were not included that could have scored better than some of the lower-performing companies that were included.

If this studied is repeated, I would include Irish promotion OTT and WWN affiliate ACW, which were omitted. It would be useful to include those companies if only because their shows are as of this writing available on FloSlam.

What does this study tell us?

It’s important to make a distinction between familiarity and favorability, especially when evaluating the market demand of this highly-aware audience. Figuring out the differences between familiarity and favorability among wrestling companies is the central issue of this study.

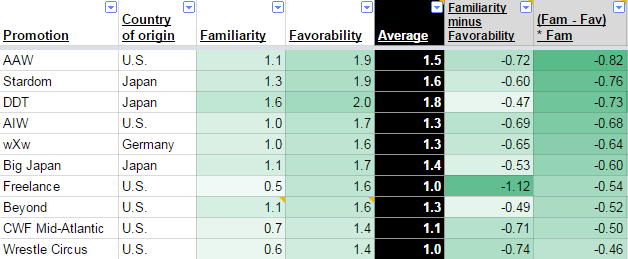

Among this discerning audience, just because a given company has high familiarity does not necessarily mean it has strong favorability with the audience. While a company may be well-known, there’s not necessarily a proportionate audience willing to buy its products. As evident from this study, companies like TNA, Combat Zone Wrestling and Global Force Wrestling don’t fare well in this manner.

Likewise, this study will show there are some companies that fewer fans are familiar with, but those who are familiar with them are very favorable toward them. The data suggests some companies have fostered exceptionally passionate fans among the sample, such as PROGRESS, DDT, New Japan, PWG, Stardom, AAW, Dragon Gate, Rev Pro, AIW, Big Japan, wXw, Beyond, EVOLVE and CMLL.

Until now there have been no examples of metrics that give a clear picture of this — albeit niche — audience’s market demand. While survey respondents were probably overwhelmingly made-up of exceptionally enthusiastic fans, the data they provided nonetheless reveals a clear and data-supported hierarchy of the world’s top 30 or so wrestling companies among English speakers. Any previous assertions I’m aware of about such a hierarchy have been purely intuitive or anecdotal — however reasonable or confirmed by this study any of those assertions may have been.

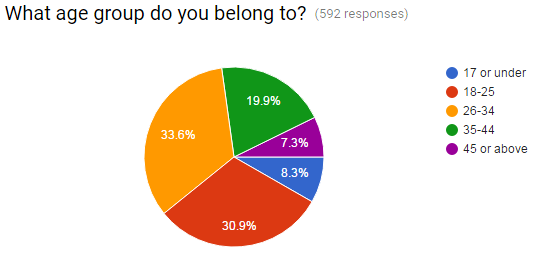

Furthermore the survey collected a significant sample size of 591 responses. The responses came from a wide variety of geographical regions and age groups. The respondents were however overwhelmingly male, which may or may not be a good reflection of this audience’s actual make-up.

Traditional metrics like TV ratings and attendance are only publicly known for a few of the companies concerned here. Or even if we knew the average attendance for all companies, it wouldn’t provide us with a clear picture of demand for a company like Pro Wrestling Guerilla which willfully runs a venue with a much smaller capacity than its capacity to sell tickets.

There are some metrics we can use to make apples-to-apples comparisons across most of these companies. Analyses of public Google trends and Wikipedia pageviews are more all encompassing. But those metrics still leave out some companies: not all have a Wikipedia page; the smaller ones don’t register a measurement on Google trends.

Social media followers are even more all encompassing. Every company concerned here has at least some semblance of a social media presence. But social media follower counts carry many misleading factors, which have been discussed at length elsewhere.

The 58 companies studied here have a wide variety of business approaches, which makes it difficult to compare their respective market demand. Rather than trying to compensate for unequal — or nonexistent — metrics, directly surveying fans who are likely to be aware of a large portion of the 58 companies provides a clearer insight into how these companies stack up against each other.

Therefore the results of the survey may be insightful to those interested in appealing to that niche of wrestling fans. In particular, these results may be insightful to entities that distribute or are considering distributing wrestling content to an English-speaking audience. This includes operations like FloSlam, the Highspots Network, Powerbomb.tv and even the WWE Network. Furthermore, these results may be insightful to any promotion or individual talent in the pro wrestling industry who wants to get an idea of where wrestling promotions stand with the so-called “hardcore audience”. And of course, these results may be interesting to members of the pro wrestling media and fans themselves for similar reasons.

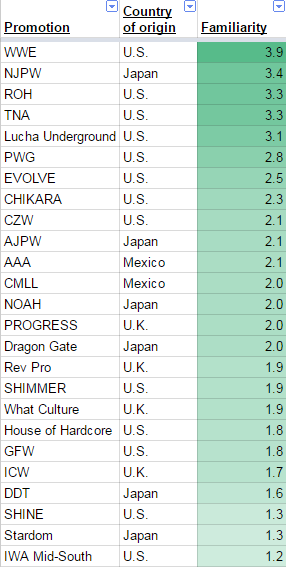

Familiarity

(See the "Simple" tab on the spreadsheet for a more complete view)

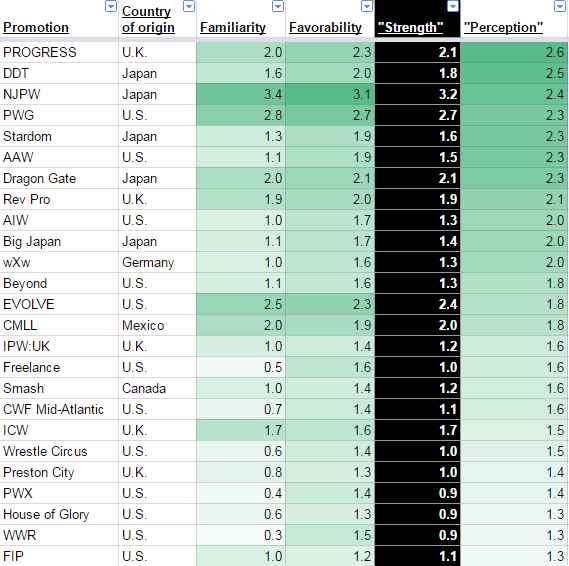

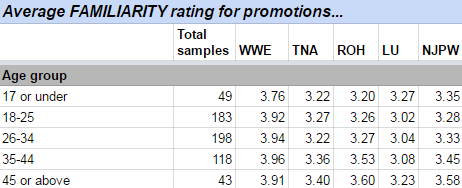

WWE tops the list for Familiarity by a fair margin, with an almost perfect score of 3.9.

After WWE is a clear second tier of four promotions, what I’d call “the small majors”:

- New Japan (3.4)

- Ring of Honor (3.3)

- TNA (3.3)

- Lucha Underground (3.1)

These companies fit together nicely in that they all sign talent to exclusive contracts and have a presence on traditional national TV, although they’re not in the league of the global giant WWE. As will be discussed later, TNA has a considerable discrepancy between its Familiarity and Favorability rating.

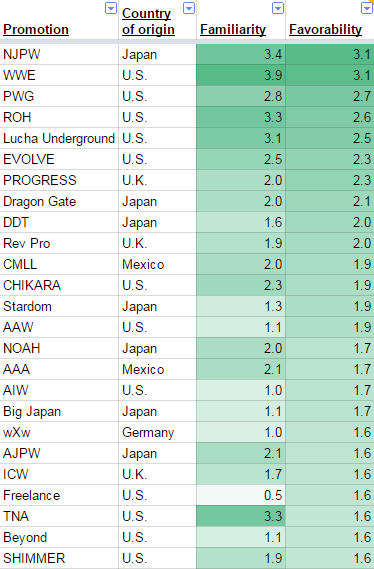

Favorability

(See the "Simple" tab on the spreadsheet for a more complete view)

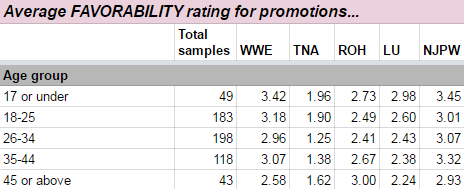

New Japan and WWE stand tied for most favored promotions with this sample. PWG actually comes in third, beating out higher profile promotions ROH and Lucha Underground.

Notice with its high 3.3 Familiarity rating, TNA scores only a 1.6 for Favorability.

The real story in Favorability is how it compares to Familiarity. In most cases, Favorability and Familiarity strongly correlate. Naturally the more you like a company, the more you become familiar with it. But there are some companies that have penetrated our consciousness and persist but whose brands are significantly damaged.

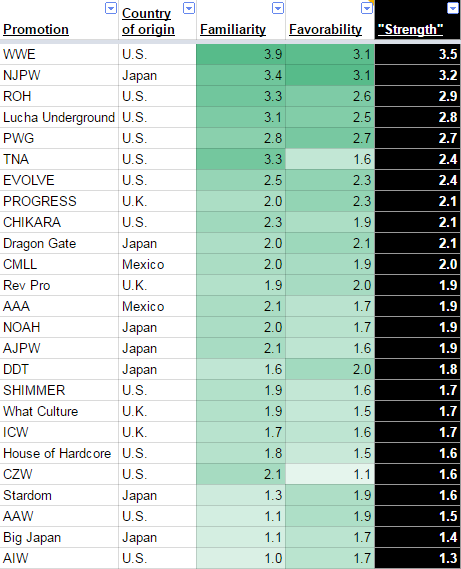

"Strength"

(See the "Simple" tab on the spreadsheet for a more complete view)

“Strength” is an appropriate shorter name for the average between the two columns we just looked at above. Averaging these two numbers together was my way of hoping to account for some of the discrepancies between familiarity and favorability.

Ranking by “Strength” benefits the promotions that had higher favorability ratings than they had familiarity ratings and penalizes the companies that had the lowest favorability ratings.

Any reasonable study of the business should tell you WWE is out in a league of its own, both in terms of recognition and revenue. Even among this sample, WWE is a tier above the rest.

WWE leads with a 3.5 rating for Strength. It’s followed by New Japan, coming in at 3.2. WWE and New Japan each have a three-point lead above the next closest company. This seems reflective of these two companies being the clear two most significant companies in the world. The next three are in a close race:

- ROH (2.9)

- Lucha Underground (2.8)

- PWG (2.7)

After those there’s another three-point gap, where TNA and EVOLVE are tied.

- TNA (2.4)

- EVOLVE (2.4)

At least to the audience sampled here, PWG is a more valuable brand than TNA, and TNA is actually on par with the value of EVOLVE.

How much a point like that matters depends on how big the real population is of an audience like the one sampled here. I think that’s the most interesting question that emerges from this study and is not answered here: How big is the niche/hardcore audience? What are the borders that even define this audience? Those are difficult and interesting questions, which if we can begin to answer will unlock a greater understanding of the pro wrestling audience.

From there the pack gets thicker, so it’s better to break down by region.

The next ten U.S. or Canadian indies for Strength are:

- CHIKARA (2.1)

- SHIMMER (1.7)

- House of Hardcore (1.6)

- CZW (1.6)

- AAW (1.5)

- AIW (1.3)

- Beyond (1.3)

- SHINE (1.3)

- GFW (1.2)

- Smash (1.2)

Especially when it comes to these smaller companies, it may be insightful to look at the “Perception” metric which will be explained in the next section.

Japanese promotions after New Japan rank on Familiarity as follows:

- Dragon Gate (2.1)

- NOAH (1.9)

- All Japan (1.9)

- DDT (1.8)

- Stardom (1.6)

- Big Japan (1.4)

- WRESTLE-1 (1.0)

All Japan, NOAH and WRESTLE-1 have weaker Favorability ratings that dragged down their Strength ratings. I’d suggest the legacies of All Japan and NOAH — both of which were at least competitive #2 promotions in Japan in other eras — boosted Familiarity ratings (and thereby the Strength ratings) of those companies. DDT and Big Japan seem undervalued here, at least compared to their status within their home market. A recent study showed that in 2016, Big Japan drew attendance competitive to that of NOAH, and DDT easily did better than either All Japan and NOAH.

I think this suggests there’s some value in the video libraries for All Japan and NOAH, although the kinds of people who took this survey and likely aware that much of those libraries are available for free on YouTube or Dailymotion at the moment.

For Strength among Mexican companies, CMLL (2.0) edges out AAA (1.9). AAA had a slightly higher Familiarity rating (2.1) than CMLL (2.0), but CMLL had a higher Favorability rating (1.9, versus AAA’s 1.7).

For the United Kingdom and Germany, the top seven companies for Strength are:

- PROGRESS (2.1)

- Rev Pro (1.9)

- What Culture Pro Wrestling (1.7)

- Insane Championship Wrestling (ICW) (1.7)

- wXw (1.3)

- IPW:UK (1.2)

- Preston City Wrestling (1.0)

- Attack (0.9)

- Southside (0.8)

- Kamikaze (0.6)

“Perception”

As noted there are some interesting differences between Familiarity and Favorability ratings for given companies. In light of an everyday attention to the pro wrestling business, these differences seem related to the sample's buzz or discontent with a given company. So I've gone further and created an additional statistic named "Perception".

But first, why isn’t the Favorability metric alone sufficient for thinking about a company's perception or “buzz”?

Favorability strongly correlates to Familiarity. Companies with lower Familiarity ratings had a virtual ceiling when it came to Favorability ratings. While there are clear exceptions, the most familiar companies tend to be the most favorably-viewed. An account of Favorability alone doesn’t take into consideration the interesting differences between Familiarity and Favorability. Unless those with the most familiarity just happen to be largely those with the most potent fan-bases, Favorability is insufficient for telling us about what we mean when we talk about perception or “buzz”.

We colloquially talk about certain promotions or wrestlers having “buzz”.

“That is gaining a lot of buzz right now.”

“So-and-so has a lot of buzz around her right now.”

“That promotion has zero buzz anymore.”

We talk about promotions having buzz that have potent fan-bases, that have a “cult following”, that have an audience that may be smaller than the largest ones but whose fans are very passionate, will go to great lengths to engage with the product and may even spend more money on the brand per capita versus other companies’ fans.

If you’re a potential distributor like FloSlam or WWE, it’s valuable to understand which companies have the most ardent followings. Companies with small but potent followings are likely to bring in more product demand than their familiarity ratings (or their favorability ratings which are heavily influenced by their familiarity ratings) may suggest. The “Perception” metric attempts to account for this phenomenon.

I considered alternatively calling this metric “Buzz” or “Goodwill”, which may be just as or, in some cases, more appropriate.

The formula is as follows:

STRENGTH – (FAMILIARITY * (FAMILIARITY – FAVORABILITY))

Why choose that formula?

With these two pure metrics (Familiarity and Favorability) at our disposal, to gain insight we have to measure the differences between them. Merely subtracting Familiarity from Favorability (or vice versa) does a good job of showing us which companies have weak perception or goodwill but lends a positive bias to companies with the lowest Familiarity ratings. If we simply consider the difference between Favorability and Familiarity as an indicator of Perception we’d find that almost all the promotions with the least familiarity have the highest Perception ratings, which doesn’t seem right for how most people think about this intangible phenomenon.

Because subtracting Favorability from Familiarity gives us a bias to companies with low familiarity, I decided to factor in Familiarity to try to adjust for that.

(See the "Analysis" tab on the spreadsheet for a more complete view)

That ranking is informative and may be suggestive of which promotions have the most passionate fans among the sample. But if we take into account Strength, and subtract it from the aforementioned product (FAMILIARITY * (FAMILIARITY – FAVORABILITY)), essentially we get a company’s strength factored by fan passion. We get an impression of which promotions have the best “pound-for-pound” value, which is what's named here "Perception".

(See the "Simple" tab on the spreadsheet for a more complete view)

The companies that rank highly here may be the ones that present the strongest investments for appealing to the hardcore fan-base.

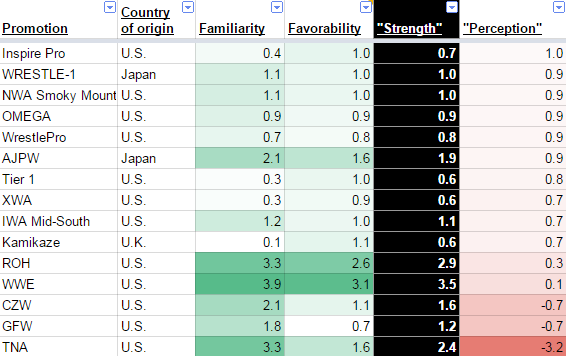

The opposite end of this ranking also tells us which promotions have discontented the sample: TNA, GFW, CZW, WWE and ROH, in that order.

(See the "Simple" tab on the spreadsheet for a more complete view)

I wouldn’t draw any conclusions about the companies in between the upper and lower extremes on this list, especially those that returned smaller numbers of favorability samples and had low ratings of familiarity to begin with. From this calculation, I don’t think we learn much about the companies like Kamikaze, XWA, Tier 1, WrestlePro, OMEGA, NWA Smoky Mountain, WRESTLE-1, Inspire Pro, etc. And many of those companies perhaps could’ve been interchanged with other companies not included in this study and returned similar familiarity scores. Again, all 58 companies considered in this study shouldn’t be taken as the 58 most significant companies in the world, but the top 30 or so are probably there.

If we only look at U.S. and Canadian indies, the top ten leaders for the Perception metric sort like this:

- PWG (2.3)

- AAW (2.3)

- AIW (2.0)

- Beyond (1.8)

- EVOLVE (1.8)

- Freelance (1.6)

- Smash (1.6)

- CWF Mid-Atlantic (1.6)

- Wrestle Circus (1.5)

- PWX (1.4)

Missing from this top ten are the four indies that actually ranked highest in Strength: CHIKARA, SHIMMER, House of Hardcore and CZW, whose Perception ratings are 1.2 or below.

If we rank U.K. and German indies by Perception, the ranking order is much closer what it was for Strength:

- PROGRESS (2.6)

- Rev Pro (2.1)

- wXw (2.0)

- IPW:UK (1.6)

- ICW (1.5)

- Preston City (1.4)

- Attack (1.3)

- Southside (1.1)

- What Culture (1.1)

- Kamikaze (0.7)

wXw rises from fifth to third-place and What Culture drops from third to ninth, which probably says something about how each of those companies are perceived. wXw is likely viewed a company that puts on shows with excellent matches, while What Culture is likely hurt by being viewed as a corporate start-up with lots of money behind it, in contrast to the grassroots promotions in its region.

Preferences Among Demographic Groups

a. Region

Among regions, as you might expect, fans have a greater preference for indies based in their home country as compared to the rest of the sample population.

Respondents in the U.S. rated their native indies higher, most notably AIW, AAW and PWX.

Respondents in the U.K. rated theirs higher. All nine U.K. indies included in the study accounted for the largest differences on Strength for the U.K. & Ireland demographic.

The greatest difference among Canadians was for their own Smash Wrestling (based in Toronto).

Respondents that said they were from any other country held greatest differences with Stardom in Japan and wXw in Germany.

By a small margin, respondents in Australia and New Zealand had a greater preference for New Japan. This demographic was also kindest to TNA, though still viewed it negatively, but viewed ROH as negatively.

b. Gender

Again, respondents overwhelmingly identified as male. Those who found the survey on Reddit as well as Twitter identified as male by the same rate of 93%.

94% of respondents were male (557 responses), 4% female (25 responses). Male respondents were higher on EVOLVE. Female respondents were higher on women’s promotions WWR, WSU and Stardom. They were less negative on TNA but it was still their most negative promotion, tied with ROH.

c. Source

Respondents who discovered the survey on Twitter were higher on U.S. indies like PWX, WWR, AAW, CWF Mid-Atlantic, AIW, AWE and Beyond. Compared to non-Twitter responses, they were more negative on ROH, PWG, Lucha Underground, WWE, TNA and New Japan.

Those who came from Reddit were slightly higher on What Culture and balanced the companies just mentioned that Twitter discoverers were negative on.

Those who came from the f4wonline.com link (who were 100% male and skewed older than the other sources) were higher on Mexican promotions CMLL and AAA, as well as PWG and Stardom. With this demographic, New Japan calculated a higher Strength rating (3.6) than WWE (3.4), one of the few demographic groups that WWE didn’t rank first with for that metric.

d. Age

Youth and ignorance are apparently bliss. Generally, if you’re older, you consider yourself more familiar with the major promotions, and the more unfavorably you view most of them, especially WWE and TNA.

The 17 or under age group were more favorable toward WWR, NECW, XWA, What Culture, Kamikaze, Inspire Pro, Dreamwave, Attack. The group was less strong on AIW.

The 18-25 age group was stronger on TNA, but still negative toward it overall.

The 26-34 age group was slightly stronger on U.S. indies AAW, AIW and Beyond. Both the 18-25 and 26-34 groups were fairly representative of the sample and deviated less than other age groups.

The 35-44 age group was more favorable toward Kamikaze and Tier 1.

With the 45 and above group, ROH was #1 in strength, in a virtual tie with New Japan and edging out WWE.

What adjustments were made to the data?

Some adjustments were made to the data. Two promotions' Twitter accounts, those of Beyond Wrestling and Tier 1 Wrestling, retweeted a tweet of mine containing the survey link. Both of these retweets occurred on December 5, 2016, in the latter range of days in which responses were collected. Both Familiarity and Favorability responses pertaining to those two promotions were eliminated from that point on if the respondent reported finding the survey on Twitter.

One respondent submitted a “0” for both Familiarity and Favorability for WWE and gave “4” ratings for both Familiarity and Favorability for every other company in the survey. It doesn’t seem plausible that one could be highly familiar and highly favorable on every company in the survey and have never heard of WWE, as the 0 Familiarity response indicates. I chose to discard this response entirely.

Conclusions

To this ardent audience, WWE is still the decisive #1 company. New Japan is the clear #2.

ROH, TNA and Lucha Underground are national brands broadcasting weekly content and are in a tier together for Familiarity. ROH leads on Familiarity, which is supported by the fact it tours nationally, while the other two don’t. TNA's market demand with this sample however is lower than that of PWG. While TNA is more Familiar to this audience, PWG's Favorability rating (2.7) nearly doubles that of TNA (1.6).

The damage that’s been done to TNA's brand is evident in its relatively low Favorability rating and its Perception rating of -3.2, which is by far the lowest of all the promotions tested. This brand damage can be corroborated by the company’s declining television viewership over the long-term (although viewership has stabilized on Pop TV), loss of multiple television partners, financial woes and inability to tour nationally with any regularity since 2014.

Though to a lesser degree, we also find evidence of frustration with WWE and ROH, again suggested by low Perception ratings (0.1 and 0.3, respectively).

WWE’s creative issues and its disregard for its most loyal fans is a point that's been recognized and belabored by a wide range of commentators, on a regular basis, for many years. ROH’s descent in this manner is a newer phenomenon, probably brought on by its limited approach to acquiring talent (via reliance on paid tryouts and perceived favoritism of talent from New England indies), uninspired booking and often incongruous television program.

PWG and EVOLVE are respectively the #1 and #2 most prestigious indies based in the U.S. and with the most demand worldwide. It’s possible however, especially thanks to its new deal with FloSlam, that EVOLVE can be tied to more revenue per year than PWG. The latter has a different business model, relying largely on DVD and ticket sales. Should being on the FloSlam platform raise EVOLVE’s profile and should PWG stick with its current model, EVOLVE could overtake PWG in the future.

PROGRESS and RevPro emerge as a similar #1 and #2 pairing, in that order, among U.K. companies. ICW and What Culture however have demonstrated an ability to draw large crowds despite less global buzz.

After New Japan, Dragon Gate has the most interest among English speaking fans. Because of their legacies, NOAH and All Japan have more recognition, but DDT, Stardom and Big Japan have more buzz than either of them.

Mexican promotions CMLL and AAA are about equally recognizable to this audience. CMLL is decidedly more interesting, probably due to a perceived superior product.

Thanks to all who took the time to participate in this survey and all who shared it, which was helpful in allowing us to obtain a larger sample size.

You may email Brandon at [email protected]. Follow him on Twitter @adecorativedrop.